Bitcoin Price and Stock-to-Flow

There are few ways to value a company:

- p/e ratios,

- discounted cashflow,

- asset valuation,

- copy someone's else number from the internet method.

But how do you put a price on an asset with no CEO, no board of directors and no financial reports? One way is to use Stock-to-Flow model, a method used to price scarce commodities like gold.

If you would rather skip to an interactive Power BI report click here.

Bitcoin

Bitcoin is a digital currency created in 2008/2009 by an unknown person (or group of people) using the name Satoshi Nakamoto. It remains the largest and most popular cryptocurrency, with a current market cap of over 1 trillion GBP. Bitcoin is the first digital asset that has the property of also being scarce, as only 21 million of BTC can ever exist. The term currency is a bit misleading. You can't buy a coffee or pay your mortgage with it, and you wouldn't want to even if you could. Bitcoin's strongest use case is its store of value (think digital gold).

It solves a problem we've had since invention of money: there is a strong incentive to debase currency by whoever is in charge. Kings did it by reducing the gold content in newly minted coins, and we do it to, except we call it quantitative easing. Bitcoin solves this problem by using cryptography and code instead of relying on a trusted centralized issuing entity. It also aligns the incentives of participants in the network. From Bitcoin's whitepaper:

The first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This adds an incentive for nodes to support the network [..]. The incentive may help encourage nodes to stay honest. If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

Although Bitcoin can't be used for jewlery and is not a good conductor of electricity, it has few valuable properties:

- scarce – there is a limited supply of 21 million bitcoins,

- digital – can be send over internet,

- decentralized – not controlled by government or institution,

- trustless – based on cryptography and code,

- permissionless – everyone with access to the internet can participate and build on top,

- transparent yet private – you can see every transaction on blockchain and still remain anonymous (to an extent, HMRC will still tax it).

Stock-to-Flow Model

Stock-to-Flow calculates a ratio between existing supply of a commodity (stock) and the newly created supply (flow). It is based on the idea that the value of a rare asset is determined by its scarcity. It was traditionally used to price scarce commodities like gold and silver. It was first applied to BTC by an anonymous Dutch trader and investor who goes by the pseudonym PlanB. Here is Nakamoto's quote taken from PlanB article:

As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong [..], not useful for any practical or ornamental purpose .. and one special, magical property: can be transported over a communications channel

Transactions on the blockchain can be inspected, so we can calculate the daily supply and flow. I used Coinmetrics API to get daily Bitcoin supply (stock). Then assuming that new bitcoins are created approximately every 10 minutes (flow), we get below numbers:

| Date | Stock-to-Flow Ratio |

|---|---|

| 2008 – 2012 | 3 |

| 2012 – 2016 | 10 |

| 2016 – 2020 | 26 |

| 2020 – 2024 | 58 |

| 2024 – 2028 | 120 |

The interpretation of this number is that it would take 120 years to recreate the current supply of Bitcoin. The number is theoretical as most of the coins were already mined (19.7 of 21 million available). According to the model, Bitcoin's value is mostly dominated by an existing stock as inflows are miniscule. The reason that we see such a big change to the stock-to-flow ratio every 4 years, is the event known as halving. The halving is written into Bitcoin protocol and causes miner's reward to be halved every 210,000 blocks (approx. 4 years):

| Halving Cycle | Miner's reward |

|---|---|

| Jan 2009 – Nov 2012 | 50 BTC |

| Nov 2012 – Jun 2016 | 25 BTC |

| Jun 2016 – May 2020 | 12.5 BTC |

| May 2020 – Apr 2024 | 6.25 BTC |

| Apr 2024 – Mar 2028 | 3.125 BTC |

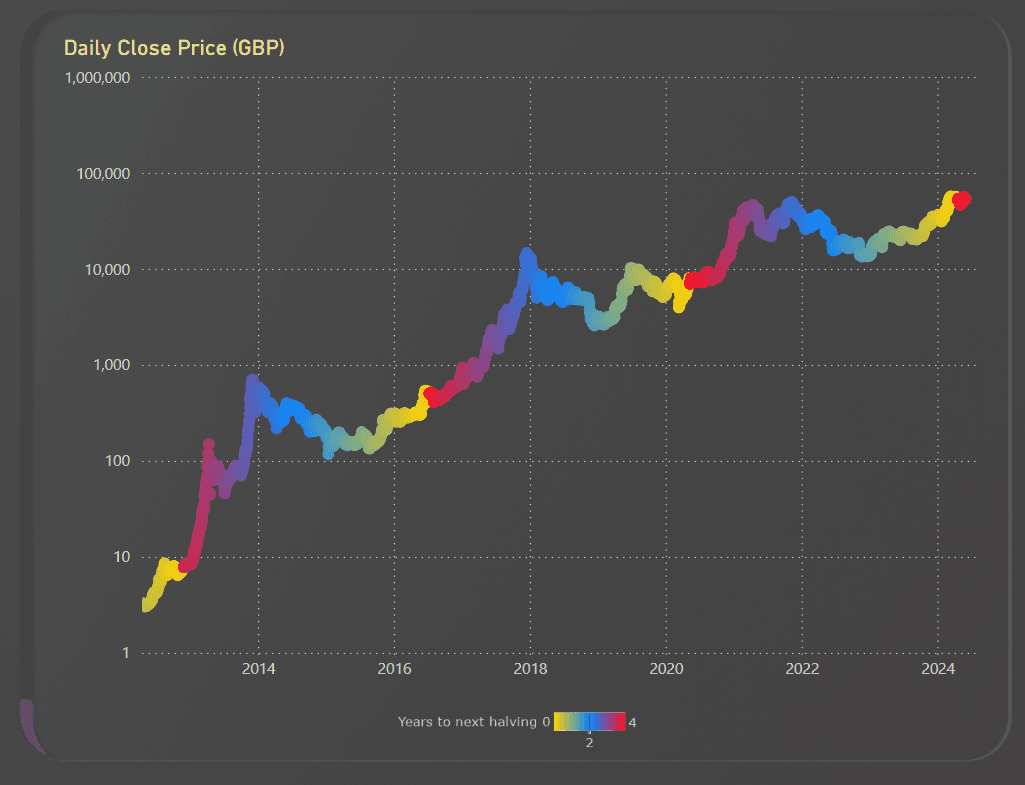

Here is a snapshot from my Power BI report showing price over time:

Few interesting observations

- The scale is logarithmic, i.e. each tick is 10x higher than the last. It must be as it spans 5 orders of magnitude

- Within 6 – 18 months after the halving (the first red dot in 2012, 2016 and 2020), we always see a price move that knocks us an order of magnitude higher. Note that always means 3 data points as it takes 4 years to play out.

- The volatility is decreasing over time. It's not apparent from the chart, but the Power BI report allows you to select a halving cycle and see some stats like the high-to-low ratios. This is something you would expect from more mature asset.

Stock-to-flow puts a price of Bitcoin at around £350k per coin by the end of 2025 (currently c. £50k). I don't like point estimates so let's say £180k – £500k.

Closing thoughts

In order for this to happen, we would need to see face melting price pumps (along with a few major corrections along the way of course). It sounds ambitious, and as much as I like this chart, we simply don't know if it will continue to play out this way. We know that halvings are important for Bitcoin, but we can't say for sure if they are the main driver of price. It may be that blockchain is a new technology that is being adopted at an exponential rate, and halvings are simply correlated with other events like global liquidity (debt being rolled every 3-5 years). We can't expect the exponential rate of adoption to continue forever. It will slow down at some point. I don't think it is likely to happen at the current level of adoption of less than 10%, and we should see at least one or two more cycles before we hit diminishing returns.

Finally, the model does not account for other variables like regulatory changes or black swan events. For example we broke the model on the upside in 2013 and 2017 but the last cycle was a bit underwhelming. We were all expecting a second leg up that never came, possibly due to mining ban in China or pandemic. It is of course also possible that the model is no longer valid and we will not see another 10x move. At this point, I am still remaining optimistic and happy to take a small bet for myself. We will find out if it was a good call soon enough.

Click here if you wish to see an interactive Power BI report.